What most people may not realize is you can develop money excuses that keep you in debt. Whether these stem from how money was handled during your childhood or habits you formed into adulthood, they are worth discovering and conquering.

The Truth About Debt

There are many circumstances and situations that land a person in debt. In fact, it’s an easy trap to fall into and stay in. The one thing most people in debt have in common is excuses. This eludes that there is a mindset shift that needs to happen in order for a person to see their ability to come out of debt much differently. But first, you have to be honest about the excuses you may be telling yourself and in hindsight keeping you in debt.

4 Money Excuses Keeping You in Debt

1. I don’t know where to start.

This excuse rules the top spot because it’s the easiest lie to tell yourself. While getting a handle on your finances can seem overwhelming, it’s not impossible or not doable. The best place to start is by looking at your income versus outcome. Your spending habits will reveal a lot about what you’re doing with your money and give you insight as to cutting back in some areas.

Typically, a quick change in spending, cutting out unnecessary bills, and saving can make a world of difference in your debt collection.

2. My income is not high enough.

There may be a number of reasons why your income is not higher; however, if you truly desire to get out of debt, then you will seek options for increasing your income. In our technologically advanced world, there are a number of online opportunities that can help you increase your income. Instead of seeing your income as not high enough, see if you can bring in other avenues of increase.

If you are waiting on your conditions to improve, you could possibly be waiting much longer than you want (or need) to. It’s always best to take action when and where you can.

3. I thought debt helped my credit score.

This is typically a lie told by creditors simply because when they do not have people in debt, they are not making money. Having a certain kind of debt can somewhat be seen as a good thing (i.e., mortgage, car payment, etc.); however, these are not reasons to get and stay in debt. It is much better to have more control over your own money versus having to give it to lenders, banks, and creditors.

4. My financial priorities are different.

Each person’s financial circumstance is certainly unique to their individual situation. But the truth of the matter is, your finances should involve every bit of your income and all of your outcomes (debts). If you haven’t done so already, now is a great time to start budgeting so you can calculate ways to bring yourself out of debt. Once you know how much money you have coming in on a monthly basis, then start tracking your debits. Look for things that can be consolidated, minimized, or cut out altogether.

Final Thoughts

Don’t let money excuses continue to keep you in debt. Instead, look for ways and set goals that will help you get your debt paid off in a reasonable amount of time. You don’t have to continue living paycheck to paycheck or month by month on a wish. Getting in control of your finances is one of the single most rewarding things you can do!

ABOUT MIKE + CARLIE KERCHEVAL

Mike + Carlie Kercheval are college sweethearts + have been passionately married since June 2000. They have been blessed with three precious children and are in their 15th year of homeschooling. Together they co-authored of the best-selling couples devotional, Consecrated Conversations™. Mike + Carlie founded Christian Marriage Adventures™ to help couples create their legacy with intention. They co-host The Marriage Legacy Builders Podcastand Legacy Marriage Builders Monthly Marriage Mentorship program.

This article was reposted and used with permission from Christian Marriage Adventure

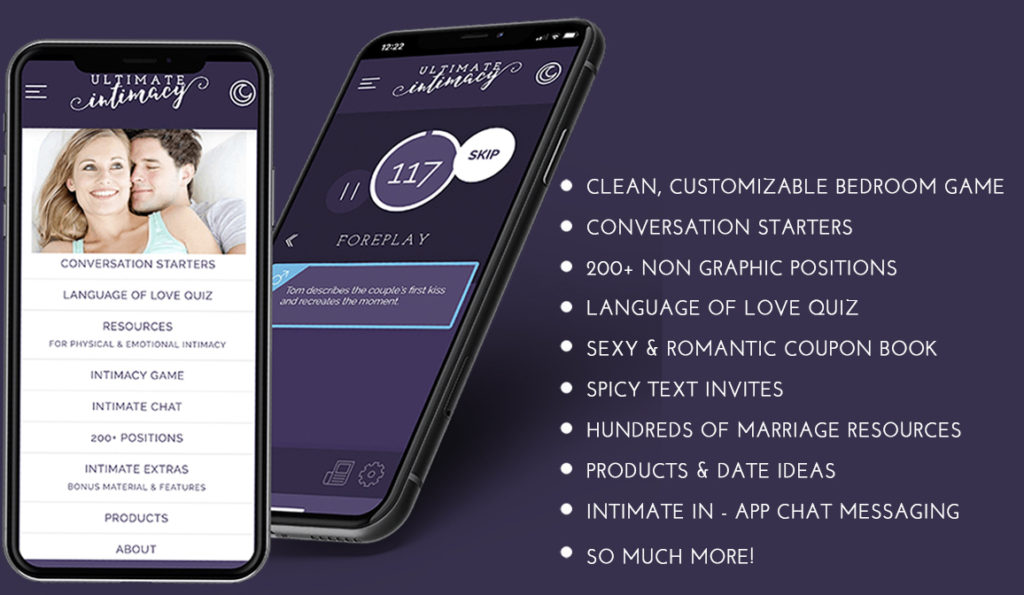

For great ideas on how to spice up your marriage, check out the Ultimate Intimacy App with tons of games, resources, articles, intimate chat and many other features you will love! It is free to download. Just click on the picture below.