One of the most critical aspects in marriage that often gets overlooked is financial stability. In a world where consumerism and easy credit are prevalent, staying out of debt becomes increasingly challenging.

We live in a time when we have to have everything now and people can’t seem to wait. We go into debt for a lot of things that we don’t need thinking those things will bring us happiness, only to find out that we get more pressure and stressed because of the debt we incur.

Maintaining a debt-free lifestyle within a marriage can yield tremendous benefits and lay the groundwork for a secure and harmonious future.

In this article, we will explore the reasons why staying out of debt is essential for a healthy and prosperous marital life.

After reading this article, you can read this blog post on How To Stay Out Of Debt In Marriage which will give you the tools you need to get out of debt, or stay out of debt.

Reduced Stress and Conflict

Financial strain is one of the leading causes of stress and conflict within marriages. Debt can create a constant burden, causing anxiety, sleepless nights, and strained relationships. We have been there in our relationship and it can cause more stress and conflict than you can imagine.

For many of you who know our story, the financial stress in our relationship almost ended our marriage. We are huge advocates of helping couples realize the importance of getting out of debt (or better managing their debt.)

By staying out of debt, couples can eliminate a major source of stress, fostering a more peaceful and harmonious environment. Instead of worrying about overdue bills or mounting interest payments, couples can focus their energy on building a solid foundation of trust, support, and happiness.

Increased Financial Freedom

Debt often limits financial freedom and hampers the ability to make choices that align with personal values and goals. By staying out of debt, couples can have greater control over their financial destiny.

They can make decisions based on what truly matters to them rather than being constrained by loan obligations or credit card balances. Whether it’s pursuing a career change, starting a family, or saving for a dream vacation, financial freedom allows couples to shape their lives in a way that brings them joy and fulfillment.

We have a saying in our marriage that we think is true:

We are giving up something now so that we can have something better in our future

When debt doesn’t control every aspect and decision you make, the financial freedom is amazing! You can afford to take work off, go on vacation, and do fun things together without the worry of “can you afford it.”

Stronger Trust and Communication

Financial matters can be a sensitive topic in any relationship. However, when couples commit to staying out of debt, it requires open and honest communication about their financial goals, spending habits, and saving strategies.

This commitment encourages couples to work together as a team, building trust and fostering a deeper connection. Regular discussions about money can help couples align their values, make joint financial decisions, and develop a solid plan for their future.

Improved Long-Term Stability

Debt can undermine long-term stability and hinder progress towards important milestones such as homeownership, retirement, or children’s education.

By avoiding debt, couples can focus on building a strong financial foundation. They can save for emergencies, invest for the future, and create a safety net that protects them from unexpected challenges. With a solid financial base, couples can feel confident about their ability to weather any storms that may come their way, providing peace of mind and stability for their future.

Setting a Positive Example

For couples who plan to have children or already have a family, staying out of debt sets a positive example for the next generation. Children learn by observing their parents’ actions and attitudes towards money. By demonstrating responsible financial behavior and showing the importance of avoiding unnecessary debt, couples can instill valuable lessons that will help their children make sound financial decisions in the future.

Breaking the cycle of debt and establishing healthy financial habits can have a profound and lasting impact on generations to come.

You may also like this podcast episode 32. How Debt and Finances Impact Physical and Emotional Intimacy.

In this podcast episode Nick and Amy interview Andy Hill from the Marriage, Kids and Money Podcast and discuss how debt, financial issues, decisions and perception of money can impact your emotional and physical intimacy in your marriage.

Even people that are very successful financially experience “financial issues” in their marriages. There are many things that could cause financial issues in a marriage. It could be debt, it could happen because one spouse is a spender and the other a saver, or one spouse like to have things paid off and the other like to finance things, or maybe you have different short and long term financial goals as a couple.

In our social media poll, 65% of couples that responded said that financial issues impact their intimacy as a couple.

Conclusion

Staying out of debt in marriage is a decision that can transform not only a couple’s financial well-being but also their overall happiness and relationship dynamics. By prioritizing financial stability, couples can reduce stress, increase their financial freedom, and build a solid foundation for their future.

Embracing a debt-free lifestyle requires commitment, open communication, and a shared vision of long-term goals. With dedication and perseverance, couples can forge a path towards financial security, trust, and prosperity, creating a marriage that thrives both financially and emotionally.

Ultimate Intimacy

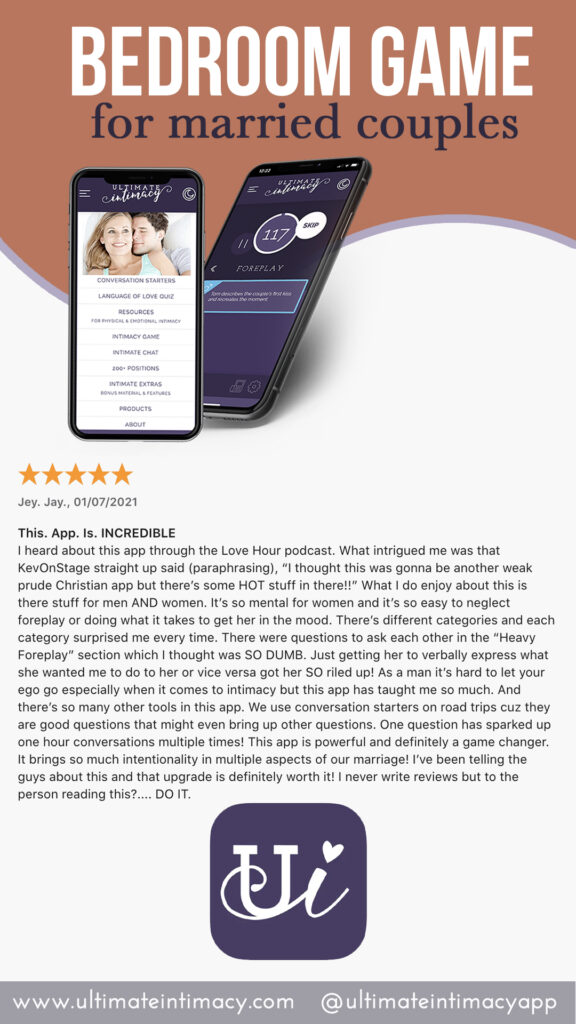

You can also check out the Ultimate Intimacy App for tons of resources to improve your marriage and intimacy. Find out why over 600,000 couples have downloaded the app and give it such a high rating!